As we begin a new year, the financial industry is bracing for a wave of changes and advancements. From new regulations aimed at keeping pace with a rapidly evolving market landscape, to the growing adoption of Central Bank Digital Currency, 2023 promises to be a year of transformation. But, what does this mean for the industry and its players? Are there hidden opportunities amidst the challenges? And, how can financial institutions adapt and thrive in this ever-changing landscape? Join us as we explore some of the key changes coming in 2023.

Regulatory Evolution

In the UK, the government have announced reforms to financial regulation designed to allow financial institutions of all kinds to keep pace with a rapidly evolving market landscape.

- A rethink on Ring-fencing. The regulations separating retail and investment banking divisions introduced after the last financial crash are under the spotlight. Removing them could be a risk, but it would pave the way for smaller banks to offer more bespoke products to their clients.

- Eco Finance under focus.The Treasury will publish an updated Green Finance Strategy in early 2023 and discuss bringing environmental, social, and governance (ESG) rating providers into regulations. Within Eurobase, ESG is being championed by our CEO Joe Locke, and the entire group embraces it.

- Cogitating on Crypto.A range of crypto activities will come under scrutiny as the UK government aims to bring in legislation to bring them under regulation. Steps like this should see digital currency moving into the mainstream, and it is also another step toward adopting a central bank digital currency (CBDC) in the UK.

The widening spread of Central Bank Digital Currency activity

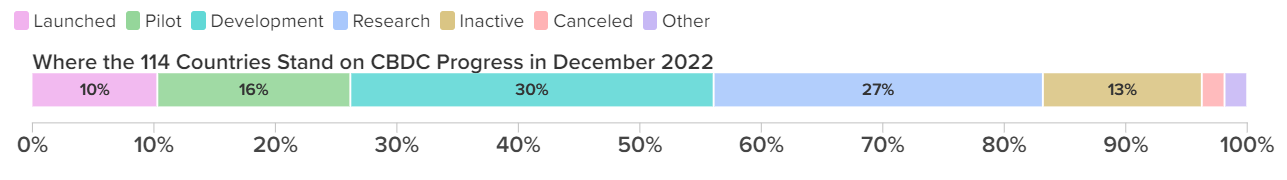

Of the 195 odd countries, 119 have looked into adopting a CBDC, which is over 61% of the world's nations. Of the 117 countries monitored by the Atlantic Council, an American think tank, 33% of those countries were actively researching CBDCs and another 28% were in active development of a CBDC.

Continued Cloud Adoption

COVID caused a change in the day-to-day working model globally. But, we should thank the capability of the cloud too. Adopting public and private cloud within the financial services sector has resulted in more flexible and dynamic working methods than we have ever seen. At Eurobase we have been actively involved in multiple conversations about all aspects of cloud adoption within banking, and we are delighted to see this, as the benefits of using the Cloud are wide-ranging. We have expanded our toolset to include a "Transaction Replayer", which is used to parallel run systems across versions, and, most importantly, across infrastructures, from bare metal to cloud, reducing both the risk and time to migrating between versions and infrastructure. Thinking cloud is very much the order of the day, which we have embraced for some time now.

Deepening Relationships in Corporate Banking

Deloitte is predicting (2023 banking and capital markets outlook) that the relationship between banks and their corporate customers will continue to change. They anticipate increased demand for digital-first, data-rich offerings coupled with expert-tailored advice, something we frequently hear from our clients, especially those operating in specialist sectors. Our experience is that the extension of value-add services to customers, and keeping up with the digital revolution are key factors for continued success in the corporate banking space.

A highlight early in 2023

A highlight of early 2023 will be the US Federal Reserve launching its CBDC, originally announced in August 2022 the service will be known as FedNow, and will aid the adoption of instant payments in the US. With around 120 organisations already signed up for the pilot program, this project is keenly anticipated and will undoubtedly be watched worldwide.