The gold rush of the millennial age is enticing, creating numerous start-ups and opportunities, with the cloud at the very centre of the promise of fortunes. The very mention of ‘on premise’ creates odd looks at tech dinner parties, with the hushed sniggering aimed at the ‘un-cool, awkward’ part of the room. Well, that’s how it seems if you believe everything you read!

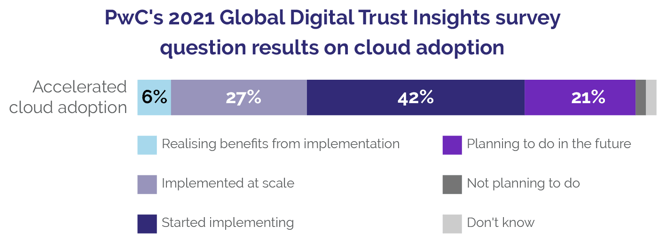

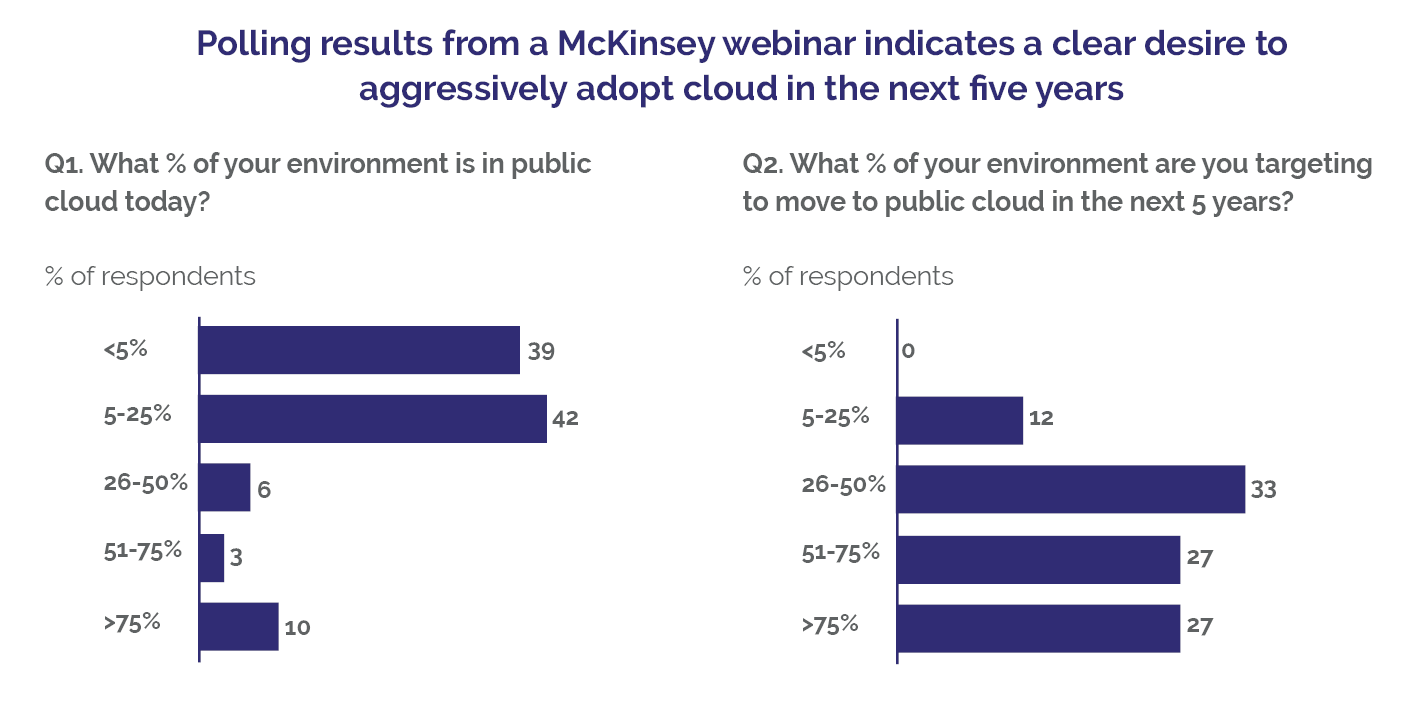

The truth is that cloud adoption has run very much at two distinct speeds, with new entrants using nothing but and existing businesses taking time to consider options and plan a risk-mitigated route or at the very least keeping the topic ‘in view’.

For more information on whether banks should adopt cloud technology for treasury, read our latest white paper ‘Can Banks Run Treasury in The Cloud?’

Are bankers making the right choices?

Typically, bankers are very conservative, focusing on the interest margin and the risks of losing money on the asset side of the balance sheet. It is also true that the questionable behaviours of some bankers in recent history were somewhat more maverick than conservative, thankfully far rarer in today’s regulatory environment. Today’s bankers and those that make the banks run as regulators wish them to, with a culture of cautious progression, will always be favoured by regulators. The regulators themselves have had to ‘go on a journey’ and now readily accept the benefits that the cloud brings to organisations. They are still less keen on maverick attitudes and behaviours in the organisations they supervise and are quick to point out where suitable skills and experience might be lacking.

“Echoing SaaS, TaaS goes beyond mere technical support. It aims to meet the very objective of modern treasury even more pointedly: eliminating inefficient and repetitive tasks that can easily be performed by someone else who is familiar with the system and understands treasury processes”

Martin Bellin, Founder and Managing Director of BELLIN Group

With a conservative approach a lot of practices and behaviours within banks remain ‘well practised’ and ‘tried and tested'. The danger here is that the risks of poor or absent consideration of appropriate technology and operating models creeps in, creating monolithic empires of spreadsheets, practices and manual processes. Whilst they may have served the bank well, the silent risks these harbour are a real concern to regulators (*see our blog last year – apologies our systems are not working right now).

Yes but what on earth does the cloud offer to people who run the banks?

Not the IT crowd, not the UX teams who create sublime user experiences, but the bankers who live and breathe liquidity, assets, liabilities, and net interest margin?

Accelerating hybrid-cloud adoption in banking and securities | McKinsey

The cloud has paved the way for vendors to offer standardised operating models, set up through configuration and creating utilities for organisations, removing the need to create bespoke operating models around common areas of the bank. Forgetting the cost benefits in such an offering, the opportunity to remove key risks is enormous and with standardised API connectivity, the banks have the ability to integrate easily within their existing ecosystems.

It’s not impossible to do this ‘on prem’ but the cost savings are not there and why change something that doesn’t look broken or doesn’t offer any immediately perceived benefit?

At Eurobase we have been working on ways to make this work for banks, without the huge costs typically falling at the feet of the CFO’s door. We believe that a great banking infrastructure is hugely important in all economies and that the trust in those enterprises must be underpinned by good quality operations. Most of you will recall the run on a high street UK bank in recent history, this isn’t pretty and whilst that was as a result of maverick attitudes to risk and trading, even simpler failures of manual processes can erode the very necessary confidence needed in banking.

If you’d like to discuss how we can help with removing manual processes and implementing low-cost technology to help manage your treasury and trading operations, come and speak to us.