The latest analysis from McKinsey exposes a reinsurance industry with freefalling returns and in urgent need of modernisation.

The 2022 Global Insurance Report by McKinsey makes for uncomfortable reading for any (re)insurer and should sound alarm bells ringing.

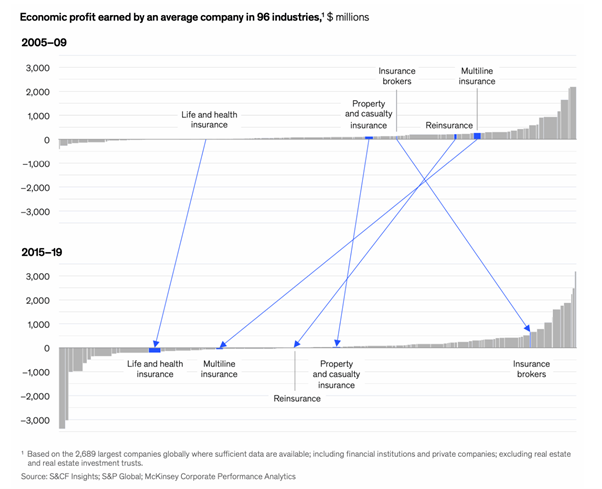

The graph below shows the return on capital across industries during two periods. The blue arrows show how the returns that (re)insurance industries can generate has changed between the periods. It is hugely concerning to see that insurers and reinsurers have not only dropped down the table but are currently struggling to cover the cost of their capital at all.

Reading the report in its entirety is strongly recommended to capture its breadth because the results are extensive and cover much more than simply the return on capital. A good summary can also be found at artemis.bm. However, a key conclusion is that (re)insurers are struggling to justify the value they add to the risk-capital chain, and that brokers (and MGAs) have taken the driving seat.

It is important to note the situation varies from region to region; in Africa and the Middle East, for example, reinsurers showed good returns on capital (albeit with significantly smaller sample size). We have focused on insurtech adoption in the emerging markets in an upcoming white paper. These regions' outperformance, as highlighted in the McKinsey report, is a good demonstration of the disruption that new entrants into these markets can achieve. Emerging markets (re)insurers are in a unique position to provide a return on capital that eludes the advanced markets.

McKinsey went on to outline a list of recommendations for (re)insurers. We have, unfortunately, seen most of them before. However, I’d like to highlight four themes that emerge from the recommendations, in the order I believe they could be tackled:

1. Modernise

The report calls out the need to replace legacy core systems that lack flexibility with digital systems that enhance the customer experience while driving back-end efficiencies. This is key given P&C reinsurers are struggling to cut costs yet, according to McKinsey, technology’s share of P&C operating costs rose by 36% between 2012 and 2020.

2. Harness data and analytics

Exploit the rapidly expanding universe of information that is now accessible to better understand your business and support decision-making.

3. Digitalise

Consumers are embracing digital channels. Having a customer-facing internet presence has gone from optional to necessary and will be critical in the future.

4. Engage with ecosystems

According to McKinsey, the insurance industry is on the verge of a paradigm shift and ecosystems could encompass $60trn of revenue by 2030. Now is the time to find niche partners and emerging technologies and integrate them into your plans.

A further point worth noting is that profitability has shifted from the carrier to the broker, and reinsurers must be increasingly selective over which risks they take on (especially when it comes to newer risks such as cyber) and in which geographies they offer products. This may not be a good thing for the market as aggregation of risk is, in some ways, dependent on a broad base of different classes – you can only exploit a niche so far.

One thing is very clear, however: competition is fierce in the post-pandemic (re)insurance market and only those players that adapt will thrive.

Subscribe To Reinsurance IQ

Stay updated with our monthly newsletter containing the latest insights for reinsurance professionals.