In my last blog The week that was the MiFID II deadline I highlighted the issue with LEI’s. This time it seems it is the turn of ISINs that are causing some turbulence below the surface of what otherwise has been a great industry effort to get the good ship (MiFID II) launched and implemented without any sharp squalls driving us onto the rocks.

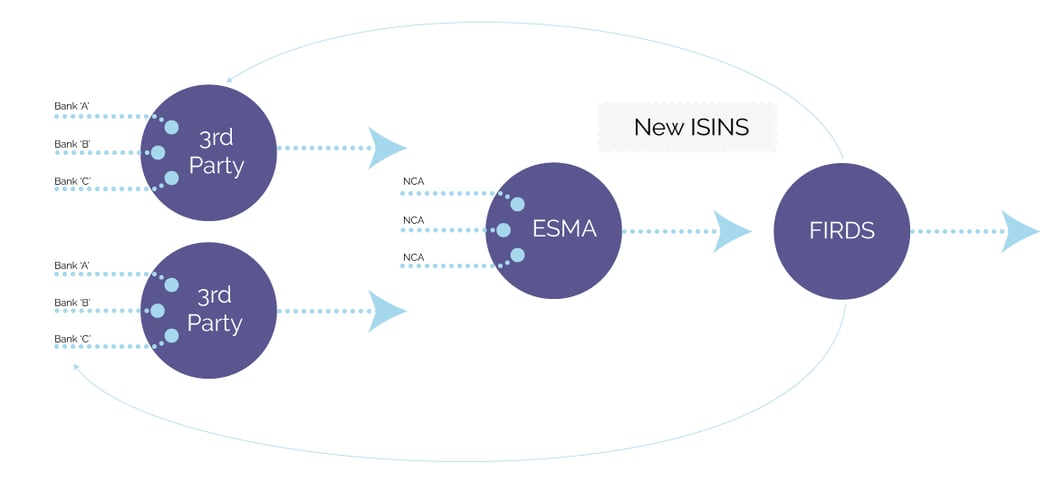

The principal headwinds seem to be the publication of ISINs in to the Financial Instrument Reference Data System (FIRDS) in a timely manner. ESMA collects ISIN’s from the NCAs and then publishes them in FIRDS. Some are pointing the finger at the venues and their failure to report ISINS meaning that FIRDS has an incomplete dataset.

The problem this then sets is that firms use third parties to obtain ISINs and send reports direct or via ARMs to NCAs having used the ISIN to determine if the transaction is reportable. The ISIN is included in the transaction report. This will pass, for example, the checks made by an ARM but then because it is not consistent with FIRDs the report, it is rejected or made to be pending. As a result, what we are seeing is firms building tighter controls around the integrity of their transaction reporting.

This has all led to a build-up at the FCA. If the transaction report is rejected but is a reportable transaction, it has to be re-reported. This is leading to a backlog of pending reports. For other firms that took the decision to use FIRDs as their source, it raises, in my opinion, a trickier problem. Due to using the ISIN to determine if a transaction is reportable they could well be not reporting genuine reportable transactions! Hopefully ESMA will provide a safe anchorage from this storm given anecdotal reports that NCAs are beginning to stiffen their attitude to potentially incorrect or missing reports. Regulatory forbearance is finite and patience will soon wear thin when it comes to transaction reporting.

What intrigues me is whether this is a level playing field across Europe. The European Commission (EC) recently requested that 12 Member States fully implement MiFID II into national legislation for which the deadline was July 2017 (extended by a year from July 2016). It appears these Member States have not fully, or not at all, implemented the new rules. It will be interesting to see what the EC response to these flagrant breaches is. In addition, what will ESMA will do regarding regulation in those countries?

The other area that seems to be generating problems is record keeping. With the new obligation to record and maintain telephone calls and electronic communications, by way of example, many firms are finding that manual workarounds are very painful. Those that have not employed a holistic solution are finding that appropriate record keeping that fulfils the requirement for monitoring is causing a multitude of issues that will just get worse.

In conclusion, the MiFID II ship is afloat and sailing but with a lot of tugs and corrections to the lines and braces. Given the ocean of data swirling around with technical difficulties at both NCAs and firms, Steven Majoor’s, (ESMA Chair), comment on the day MiFID II came into force hinting that we might hit some crosswinds “in the coming days or months” was spot on. My forecast is for these squalls and storms to be still with us as we sail into the second half of the year and set our sights on MiFID III.

The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.

- William Arthur Ward